The Importance of Volume in Stock Pattern Analysis

Introduction to Stock Pattern Analysis:

Welcome to the exciting world of stock pattern analysis, where decoding the language of charts can pave the way to better-informed trading decisions. If you’re new to the stock market, understanding how prices move may seem like solving a puzzle. That’s where stock pattern analysis comes in handy—it’s like having a decoder ring for the market’s hidden messages.

At its core, stock pattern analysis involves studying historical price movements to identify recurring patterns that may indicate potential future price directions. Imagine looking at a stock chart as a timeline of a company’s journey in the market. Patterns emerge when certain price movements repeat over time, creating recognizable shapes. These shapes, like triangles, flags, and head-and-shoulders, are the language of the market, and learning to interpret them can provide valuable insights into potential future trends.

Understanding Volume as a Key Indicator:

In the unpredictable world of stock trading, it’s crucial to have a few tricks up your sleeve, and one of the most powerful tools in your arsenal is understanding volume. Volume refers to the number of shares traded during a given time frame, and it’s like the heartbeat of the stock market. Just like a doctor checks your pulse to gauge your health, traders look at volume to understand the health of a stock. This key indicator is vital for both beginners and seasoned traders alike, serving as a compass to navigate the intricate patterns of the market.

When you observe a stock chart, each candlestick or bar not only represents the price movement but also encapsulates the trading volume during that period. A surge in volume often indicates increased interest and conviction among traders, suggesting that a significant move might be underway. On the contrary, low volume during a price change might signal a lack of enthusiasm, raising doubts about the sustainability of the trend.

Understanding volume as a key indicator involves recognizing its role in validating or contradicting price trends. For instance, if a stock experiences a sudden price surge accompanied by a substantial increase in volume, it’s likely a strong and sustainable trend. Conversely, a price rise on low volume may be a temporary blip, and caution should be exercised.

Volume and Price Action Correlation:

In the dynamic world of stock trading, understanding the relationship between volume and price action is essential for making informed decisions. Volume, simply put, represents the number of shares traded during a specific period. When analyzed in conjunction with price movements, it provides valuable insights into market dynamics.

Imagine a bustling marketplace where the more people buying or selling, the more likely prices are to move. Similarly, in the stock market, a surge in volume often accompanies significant price changes. High volume during an upward movement suggests strong buyer interest, reinforcing the bullish trend. Conversely, increased volume during a decline indicates heightened selling pressure, signaling a potential downtrend.

Common Stock Patterns and Their Volume Characteristics:

Symmetrical Triangles:

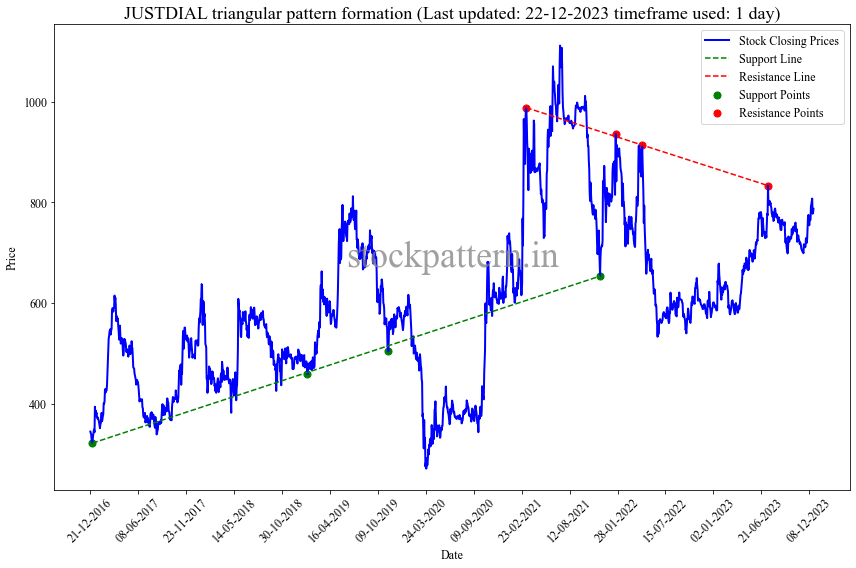

One type of triangular pattern is the symmetrical triangle, characterized by converging trendlines forming a symmetrical shape. When the price approaches the apex, a breakout is likely. Novice traders should observe volume closely during this time. A surge in volume as the price breaks out from the triangle indicates a potential strong movement in the breakout direction. This volume confirmation can add conviction to the trade for those just starting in the stock market.

Ascending and Descending Triangles:

Ascending triangles have a flat upper trendline and a rising lower trendline, while descending triangles have a declining upper trendline and a flat lower trendline. Both patterns suggest an impending breakout, and volume can offer vital clues. Increased volume during the breakout confirms the strength of the move, providing novice traders with confidence in their trading decisions.

Volume Confirmation in Trend Reversals:

In the dynamic world of stock trading, identifying potential trend reversals is a key skill that can make or break a trader’s success. One powerful tool in this arsenal is understanding how volume can confirm these reversals. Picture this: you’re analyzing a stock chart, and you notice a significant change in trend direction. This is where volume confirmation steps in to validate the reliability of that trend reversal signal.

Volume confirmation essentially means checking if the change in price direction is supported by a surge in trading activity. When a stock’s price starts moving in the opposite direction, a spike in trading volume suggests that the market is backing this change. Novice traders often overlook this crucial element, but it acts as a sort of vote of confidence from the broader market participants.

For instance, if you’re witnessing a stock moving from a downtrend to an uptrend, a surge in volume as the price heads upward strengthens the likelihood of a genuine trend reversal. This phenomenon holds true for various chart patterns, such as head and shoulders, double bottoms, or triangles. By paying attention to volume, even novice traders can gain valuable insights into the strength and sustainability of a potential trend reversal.

In conclusion, incorporating volume confirmation into your stock pattern analysis can significantly enhance your ability to spot reliable trend reversals. By acknowledging the collective wisdom of the market participants expressed through trading volume, you empower your trading decisions with a more informed perspective. As you embark on your trading journey, remember that volume is not just about the quantity of trades; it’s about the story those trades tell about the future direction of a stock’s price.

Volume Spikes and Breakouts:

In the dynamic world of stock trading, understanding the relationship between volume spikes and breakouts is crucial for making informed investment decisions. Volume, which represents the number of shares traded in a given period, often acts as a powerful signal when combined with price movements. Novice traders can gain a significant edge by recognizing the significance of volume spikes in predicting potential breakouts.

Volume spikes, marked by a sudden surge in trading activity, are like flashing indicators on a trader’s dashboard. These spikes signify increased interest and participation in a particular stock. Imagine a crowded marketplace – when more people are present, there’s a higher chance of significant transactions taking place. In the stock market, a volume spike suggests that something noteworthy is happening with the stock.

Now, let’s dive into the concept of breakouts. A breakout occurs when a stock’s price moves beyond a previously established level of resistance, often reaching new highs. Breakouts can be a game-changer for traders, leading to substantial gains. When volume spikes accompany a breakout, it indicates a strong consensus among traders about the stock’s potential.

Intraday vs. Long-Term Volume Analysis:

Intraday Volume Analysis:

For those engaged in day trading, where positions are opened and closed within a single trading day, intraday volume analysis is crucial. High intraday volumes often accompany price fluctuations, signaling potential opportunities or risks. Novice traders should pay close attention to volume spikes during specific time frames, especially around market openings and closings. By incorporating intraday volume analysis, traders can spot trends, identify support and resistance levels, and make timely decisions to capitalize on short-term market movements.

Long-Term Volume Analysis:

Long-term investors, on the other hand, take a more patient approach, holding onto stocks for an extended period. When conducting long-term volume analysis, it’s essential to look at broader trends and sustained volume patterns over weeks, months, or even years. Consistent, high volumes during an uptrend or downtrend can validate the strength of a trend, helping investors make informed decisions about entry or exit points. Long-term volume analysis is less concerned with daily fluctuations and more focused on the overall health and potential growth of a stock.

Beyond the basics: Elevate your trading with stockpattern.in’s cutting-edge tools

If you’re eager to take your stock pattern analysis to the next level, look no further than stockpattern.in. Our website is a hub of cutting-edge tools and resources designed to empower traders of all levels. At stockpattern.in, we harness the power of AI to provide precise stock pattern detection, giving you a significant edge in identifying potential buy and sell opportunities. Our platform covers stock patterns across various time spans, from intraday movements to patterns spanning a decade. This comprehensive approach ensures that you have a nuanced understanding of historical and real-time data, enabling you to make well-informed decisions.

One standout feature of stockpattern.in is our daily profit alerts delivered straight to your inbox. Stay ahead of the curve with the latest stock patterns and market updates, allowing you to capitalize on opportunities efficiently. Our commitment to keeping you informed extends beyond alerts, as stockpattern.in serves as an educational content hub. Access our extensive library of resources, exploring diverse trading strategies and insights to enhance your knowledge and proficiency in the world of stock trading.

At stockpattern.in, we pride ourselves on uncovering breakouts before the masses. Our platform provides you with stock pattern insights that reveal breakout opportunities well before the broader market catches on. Whether you’re a novice trader looking to sharpen your skills or a seasoned investor seeking an edge, stockpattern.in is your go-to destination for a seamless blend of technology, analysis, and education in the dynamic realm of stock trading. Visit us today and embark on a journey towards more informed and profitable trading decisions.