The Role of Stock Patterns in Technical Analysis

Introduction to Technical Analysis:

Welcome to the exciting world of stock market analysis! If you’re a new trader, understanding how prices move in the market is crucial. This is where technical analysis comes into play. Simply put, technical analysis is a method used to evaluate and predict future price movements by analyzing historical market data, primarily through charts and statistical tools.

Imagine you’re planning a road trip. Before hitting the road, you might check the weather forecast, look at the map, and consider the conditions for a smooth journey. In a similar way, technical analysis helps traders forecast the “weather” of the stock market. It involves studying charts that represent a stock’s historical price movements. These charts provide insights into trends, patterns, and potential future directions.

The Basics of Stock Patterns:

In the exciting world of stock trading, understanding the basics of stock patterns can be your key to unlocking the secrets of market movements. Stock patterns are like the footprints left by the market, revealing clues about its future direction. Imagine you’re looking at a chart, and you notice a series of peaks and valleys forming distinct shapes—these are the stock patterns. One commonly recognized pattern is the ‘head and shoulders,’ resembling, well, a head and shoulders! Other patterns include triangles and double tops or bottoms. These patterns aren’t just random doodles; they often signal potential changes in stock prices.

Trends and Reversals: Unraveling the Secrets of Stock Patterns

1. Introduction:

Understanding trends and reversals is like deciphering the heartbeat of the stock market. Imagine trends as the market’s rhythm, moving in a particular direction over time. For novice traders, spotting these trends is crucial. A trend is the general direction in which a stock or the market as a whole is moving – either up, down, or sideways. Recognizing and riding these trends can be a game-changer for investors.

2. Spotting Trends:

Trends are often depicted on charts, making it essential to utilize charting tools and platforms for analysis. An upward trend, known as a bullish trend, signifies a series of rising peaks and troughs. On the other hand, a bearish trend, indicating a downward movement, is characterized by falling peaks and troughs. Novice traders can easily identify these trends by observing the overall direction of a stock’s price movement. Integrate images of charts displaying clear bullish and bearish trends to visually illustrate these concepts.

3. Reversals:

While trends provide a roadmap, reversals are like unexpected turns in the market journey. Identifying potential reversals is crucial for traders looking to buy low or sell high. Common reversal patterns include the ‘double top’ and ‘double bottom,’ where prices hit a peak or trough twice before reversing direction. Candlestick patterns also play a role in signaling potential trend changes. Understanding trends and reversals is not just about analyzing numbers; it’s about reading the story that stock patterns tell, empowering traders to make informed decisions in the dynamic world of the stock market.

Pattern Recognition and Interpretation: Unlocking the Secrets of Stock Charts

In the world of stock trading, understanding patterns is like deciphering a visual code that can reveal potential future market movements. Patterns, often formed by the arrangement of price and volume on stock charts, provide valuable clues to traders and investors. Recognizing these patterns and interpreting their implications is a crucial skill for anyone navigating the financial markets.

When we talk about pattern recognition, we are essentially looking for recurring shapes and formations on stock charts. These patterns can be categorized into various types, such as reversal patterns, continuation patterns, and consolidation patterns. For instance, a ‘head and shoulders’ pattern might suggest an upcoming trend reversal, while a ‘flag’ pattern could indicate a temporary pause in an existing trend.

To interpret these patterns effectively, it’s essential to consider the broader context of the market and the specific conditions under which the pattern is emerging. Novice traders can benefit from visual aids like annotated charts that highlight the key elements of each pattern.

Psychology Behind Stock Patterns:

Consider the stock market as a vast ocean with different currents and waves. Within this ocean, stock patterns act as ripples and waves that reflect the underlying emotions and behaviors of market participants.

Picture yourself on a beach, observing the ebb and flow of the waves. Suddenly, you notice a distinct pattern where the waves break in a specific way, creating a unique rhythm. This pattern represents a “breakout” in the stock market. Traders who can recognize these patterns are like skilled surfers who anticipate and ride the waves with precision.

Just as a skilled surfer studies the ocean’s movements to catch the perfect wave, investors analyze stock patterns to identify potential opportunities. A breakout pattern, in this context, is analogous to the moment when a surfer catches a wave that deviates from the regular rhythm, signaling a shift in the market dynamics. Understanding the psychology behind these patterns is akin to deciphering the language of the ocean, allowing traders to navigate the markets with greater insight and confidence.

Limitations and Challenges in Using Stock Patterns: A Novice Trader’s Guide

Understanding stock patterns is a valuable skill for any trader, but it’s crucial to be aware of the limitations and challenges associated with relying solely on these visual cues for decision-making. Novice traders often dive into technical analysis with the hope of finding foolproof patterns, but it’s essential to recognize that markets are dynamic, and patterns may not always play out as expected.

One major limitation is the subjectivity of pattern interpretation. What one trader identifies as a bullish signal, another might see as a neutral pattern. Additionally, patterns are historical indicators and don’t guarantee future outcomes. Market conditions can change rapidly, rendering certain patterns less reliable. Novice traders should avoid the pitfall of over-reliance on patterns without considering broader market trends and news events that can significantly impact stock prices.

Another challenge is the prevalence of false signals. Not every pattern leads to a successful trade, and some can result in losses. It’s essential for novice traders to employ risk management strategies and not solely base their decisions on the presence of a pattern. Moreover, the effectiveness of patterns may vary across different timeframes, making it important for traders to consider the context in which a pattern is forming. Incorporating other technical indicators and staying informed about market fundamentals can help mitigate these challenges.

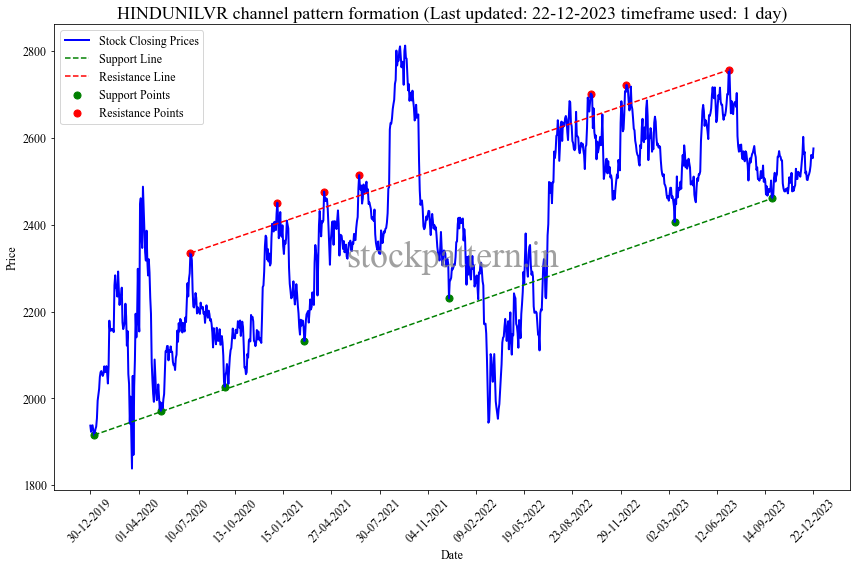

Introducing stockpattern.in:

Are you ready to elevate your trading game? Look no further than stockpattern.in, your go-to platform for cutting-edge, AI-enhanced stock pattern detection. We understand the challenges that traders face when navigating the complex world of stock markets, and that’s why we’ve harnessed the power of artificial intelligence to bring you precise and reliable stock pattern analysis.

Our AI technology goes beyond traditional methods, offering a level of accuracy and efficiency that sets stockpattern.in apart. Whether you’re a seasoned trader or just starting, our platform caters to all experience levels. Our user-friendly interface allows you to seamlessly navigate through AI-generated stock patterns, providing you with the insights you need to make informed decisions.

What sets us apart is our commitment to multi-timespan stock pattern analysis. We recognize that market dynamics evolve across different timeframes, and our platform empowers you to grasp the bigger picture. By offering comprehensive insights into short-term and long-term patterns, stockpattern.in ensures that you have the information you need to stay ahead in an ever-changing market.

Join stockpattern.in today and unlock the potential of AI-driven stock pattern detection. It’s time to trade smarter, trade confidently, and embrace the future of stock market analysis. Your success starts here!